10 Simple Techniques For Property By Helander Llc

10 Simple Techniques For Property By Helander Llc

Blog Article

6 Simple Techniques For Property By Helander Llc

Table of ContentsProperty By Helander Llc Things To Know Before You BuyGet This Report on Property By Helander LlcOur Property By Helander Llc IdeasThe smart Trick of Property By Helander Llc That Nobody is Talking AboutNot known Details About Property By Helander Llc 5 Simple Techniques For Property By Helander Llc

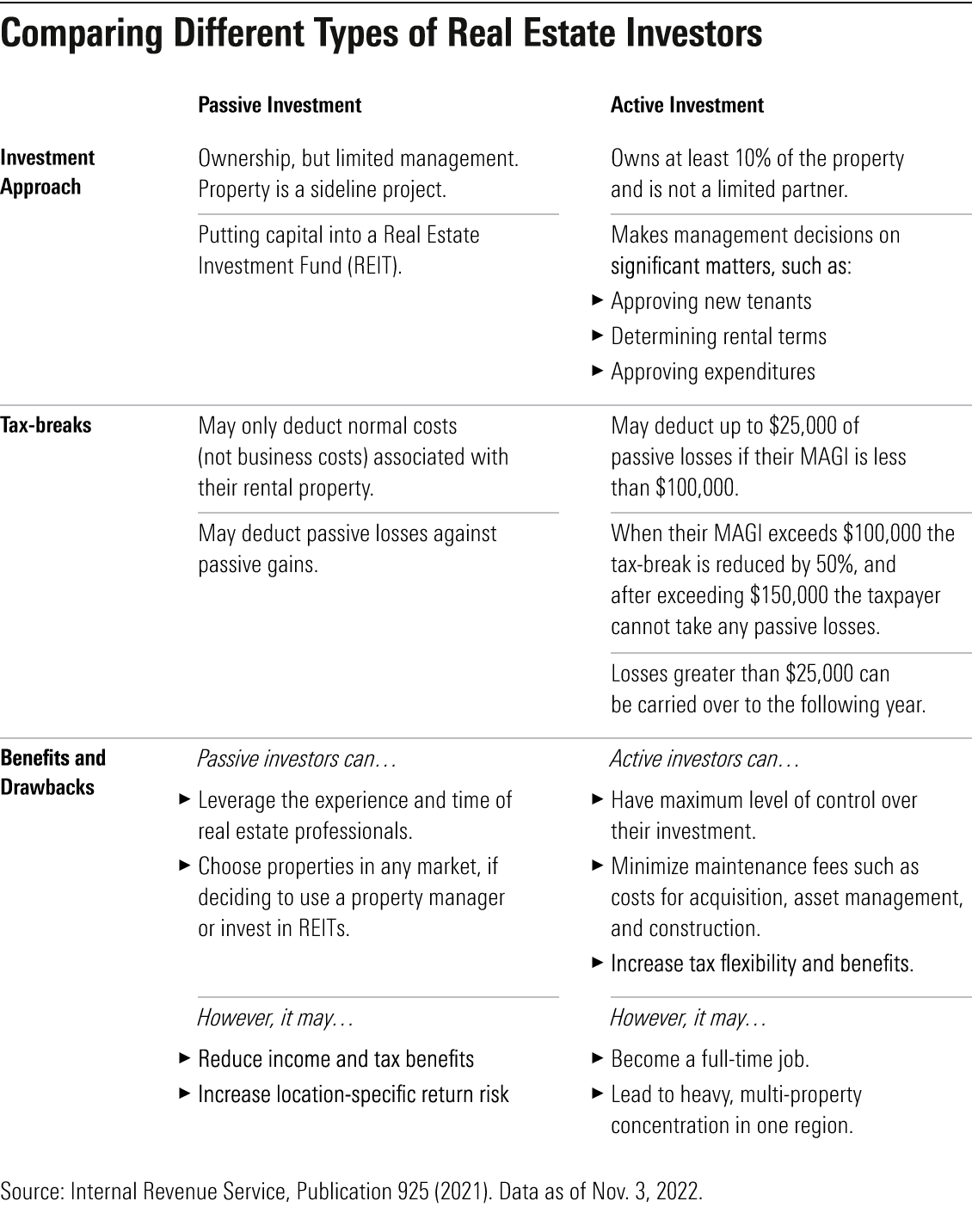

The advantages of investing in genuine estate are many. Right here's what you need to know concerning genuine estate advantages and why actual estate is considered an excellent financial investment.The advantages of spending in actual estate include easy revenue, secure cash money flow, tax advantages, diversification, and leverage. Genuine estate financial investment trusts (REITs) supply a means to spend in real estate without having to possess, run, or finance buildings.

In several situations, capital just strengthens gradually as you pay for your mortgageand accumulate your equity. Investor can capitalize on various tax breaks and reductions that can save cash at tax time. Generally, you can subtract the reasonable prices of owning, operating, and handling a residential property.

Examine This Report on Property By Helander Llc

Real estate values have a tendency to increase over time, and with a great investment, you can turn an earnings when it's time to sell. As you pay down a property home loan, you build equityan asset that's part of your net well worth. And as you construct equity, you have the take advantage of to get even more residential properties and boost cash circulation and wide range even extra.

Because property is a tangible property and one that can function as security, funding is readily offered. Realty returns differ, depending upon aspects such as location, possession course, and management. Still, a number that numerous financiers go for is to beat the typical returns of the S&P 500what lots of individuals refer to when they claim, "the market." The inflation hedging capacity of realty comes from the positive relationship in between GDP development and the need for actual estate.

The Property By Helander Llc Statements

This, in turn, converts into greater resources values. Consequently, actual estate tends to keep the purchasing power of resources by passing some of the inflationary pressure on to renters and by incorporating several of the inflationary pressure in the kind of resources recognition. Home mortgage image source lending discrimination is unlawful. If you assume you have actually been discriminated versus based upon race, religious beliefs, sex, marriage condition, use public assistance, nationwide beginning, impairment, or age, there are actions you can take.

Indirect property investing involves no direct possession of a property or buildings. Rather, you purchase a pool along with others, wherein a management company possesses and runs homes, otherwise has a portfolio of home loans. There are numerous manner ins which owning real estate can shield against inflation. Initially, residential property values may increase greater than the price of inflation, resulting in capital gains.

Residential or commercial properties financed with a fixed-rate lending will see the relative amount of the monthly home loan repayments drop over time-- for instance $1,000 a month as a fixed repayment will certainly become less troublesome as rising cost of living wears down the acquiring power of that $1,000. https://www.openlearning.com/u/frederickriley-sgnmtw/about/. Often, a key home is not considered to be a realty investment given that it is made use of as one's home

Property By Helander Llc Fundamentals Explained

Despite having the aid of a broker, it can take a couple of weeks of job just to find the appropriate counterparty. Still, property is a distinct possession class that's simple to comprehend and can enhance the risk-and-return profile of a capitalist's profile. By itself, property uses capital, tax breaks, equity structure, competitive risk-adjusted returns, and a hedge against inflation.

Purchasing realty can be an extremely fulfilling and financially rewarding venture, however if you resemble a great deal of brand-new capitalists, you might be wondering WHY you need to be buying property and what benefits it brings over various other investment chances. Along with all the remarkable benefits that come with buying realty, there are some downsides you require to take into consideration as well.

Property By Helander Llc for Dummies

If you're seeking a way to acquire right into the realty market without needing to spend numerous countless bucks, check out our properties. At BuyProperly, we use a fractional ownership model that permits financiers to start with just $2500. Another significant advantage of realty investing is the capability to make a high return from buying, renovating, and reselling (a.k.a.

Unknown Facts About Property By Helander Llc

For instance, if you are charging $2,000 lease per month and you sustained $1,500 in tax-deductible costs per month, you will only be paying tax on that $500 earnings monthly. That's a large difference from paying taxes on $2,000 each month. The earnings that you make on your rental system for the year is taken into consideration rental income and will certainly be taxed appropriately

Report this page